- Home

- For freelancers

- Become self-employed, step by step

Become self-employed, step by step

Become self-employed, step by step

Becoming self-employed is not something to take lightly. Before you begin, answer a few key questions to make sure you know where you stand and have everything you need.

- In what do you want to become self-employed?

- Which company type should you choose: sole proprietorship or company?

- Do you want to become self-employed as a main or secondary occupation?

- What costs do you have to incur to become independent?

1. In what do you want to become self-employed?

Before setting up your business, it is of course crucial that you know what you want to do as a self-employed person. Some important questions to answer, are:

- In which sector do you want to work?

- Do you want to sell products or services, or maybe a combination?

- What sets you apart from your competitors?

- Can you rely on inspiration from others?

- Is there sufficient demand for your offer and the way you present it?

- Who is your audience and how do you reach them?

- Do you want to start as a freelancer or would you rather select a different status?

To answer all these questions in a substantiated and structured way, it is best to draw up a business plan. Even if a business plan is not mandatory - for example if you set up a sole proprietorship - you still gain a lot of valuable information from it.

Which company type is best: sole proprietorship or company?

Since the the reform of company types in 2019, there are a lot fewer company types than before, a major simplification.

Although there are a few different company types, the biggest decision you have to make is whether you want to start a sole proprietorship or a company. An overview of the advantages and pitfalls:

2.1 Advantages of a sole proprietorship

- A sole proprietorship is very easy to start and run. Accountancy is quite simple and there is little involved in the start-up process.

- There’s no required starting capital, you can start immediately with what you have.

- Since you’re the only owner, you can make all decisions yourself. You are also very flexible in how much you pay yourself monthly.

2.2 Pitfalls of a sole proprietorship

- You remain a natural person and therefore pay personal income tax on all your income. Personal income tax is quite a lot higher than company tax, meaning you end up paying a lot more.

- The fact that you remain a natural person also makes you personally liable when issues arise. You are not protected and you bear all financial risks yourself.

- Selling your business is more difficult with a sole proprietorship. Moreover, you then pay the higher personal taxes on the profits from your sale.

2.3 Advantages of a company

- Advantageous corporate taxes mean that you have more left over at the end of the day.

- Liability is limited and you are better protected because the legal entity of your company is liable, not you as a natural person.

- The articles of association drafted when you start your company regulate your way of working and create transparency. Moreover, you can easily hand over your company to someone else when you want to. You don't even need a notarial deed for it.

2.4 Pitfalls of a company

- You have to engage a notary for the starting procedure which requires more starting capital. It’s also a more complex process to get everything running smoothly.

- Stricter accounting requires more support and makes payments more complex than with a sole proprietorship.

- You pay yourself a predetermined wage, but all your profits and additional income remain tied up in your company for several years before you can enjoy them at a lower tax bracket.

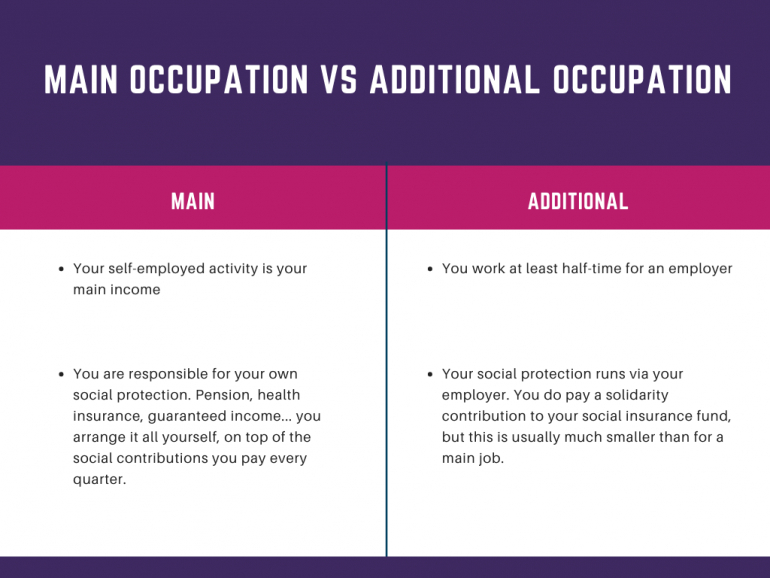

Do you want to become self-employed as a main or secondary occupation?

You don't have to jump in the deep end to become self-employed. Depending on your business plan, your vision for the future and your own preferences, you may prefer to start as a secondary occupation, regardless of whether you opt for a sole proprietorship or company.

A short comparison between starting a main or a secondary occupation:

4. What costs are involved in becoming self-employed?

If you start a business, it is best to take a number of costs into account. Although the exact details depend on various factors - company form, social status, income, interpretation - these costs will always be part of the equation.

- Formation costs: for a company you need start-up capital, for example as a sole proprietor, you pay your registration at the business counter.

- Administrative costs: if you need permits or request additional NACEBEL codes after your establishment, you will pay administrative and processing costs.

- Social contributions: you’ll pay social contributions to your social insurance fund every quarter. How your social security contributions are calculated depends on several factors.

- Accountant: a good accountant monitors the deadlines for your VAT returns, calculates your personal taxes and provides valuable advice.

- Insurance: it is best to invest in some smart insurance policies, especially for a main occupation, but also in a secondary occupation. Which insurance you need depends on your job content and status.

- Taxes: you pay VAT on every invoice you issue, so always set aside the amount of VAT you’ll need to pay pending your VAT return and the subsequent payment. In addition, you’ll pay corporate and/or personal taxes, depending on your company form.

Get advice

Not sure which company type suits you best? Any other questions specific to your situation in IT? Then get free advice from the experts at Brainbridge to smoothly become self-employed

Deals for starting self-employed individuals.

With "Benefits @ work", we want to offer discounts to self-employed individuals on the purchase of important services or products. This saves the self-employed individuals who are affiliated with us a nice amount per year that they can use for other fun things.

- It's easy and quick: claim your deals quickly and easily!

- We can close deals for you for a wide range of products and services.

- With Benefits @ work, your self-employed life becomes super easy.

- It's free.